Mastercard is collaborating with US institutions to test shared-ledger technology for settling tokenized assets like commercial bank money.

In order to test shared-ledger technology with the intention of facilitating the common settlement of tokenized assets, Mastercard Inc. has embarked on a groundbreaking collaboration with some of the top institutions in the United States.

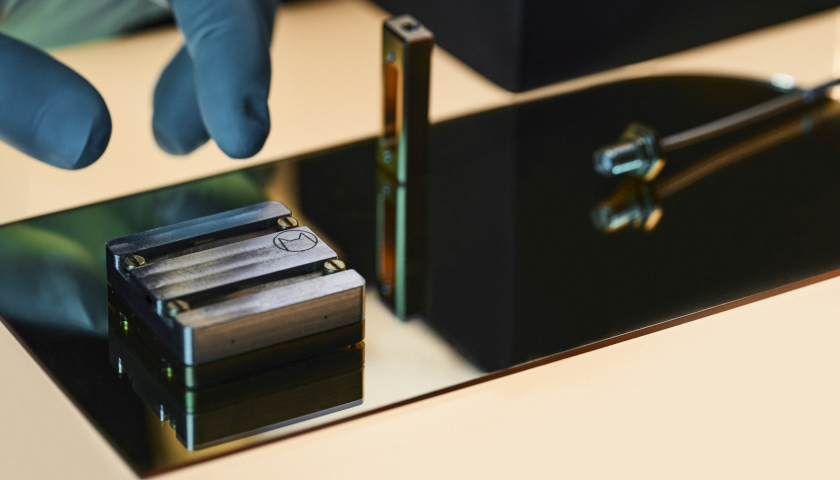

Mastercard Collaborates To Test Tokenized Asset Settlement

These assets include commercial bank money, Treasury-issued securities, and investment-grade debt securities. The endeavor, known as the proof-of-concept for the Regulated Settlement Network aims to replicate transactions in US dollars.

The ultimate objective as stated by Mastercard is to improve the speed and efficiency of international transactions while simultaneously reducing the risks associated with errors and fraudulent activity.

Transformative Potential of Ledger Technology

The implementation of ledger technology has the potential to bring about a transformation in the current financial transaction environment. At the moment, assets such as money from commercial banks and securities such as investment-grade debt are considered to be operating on distinct systems.

On the other hand, if we convert these assets into tokens that run on a distributed ledger, the settlement operations could occur on a uniform platform.

Read more: coinedition.com