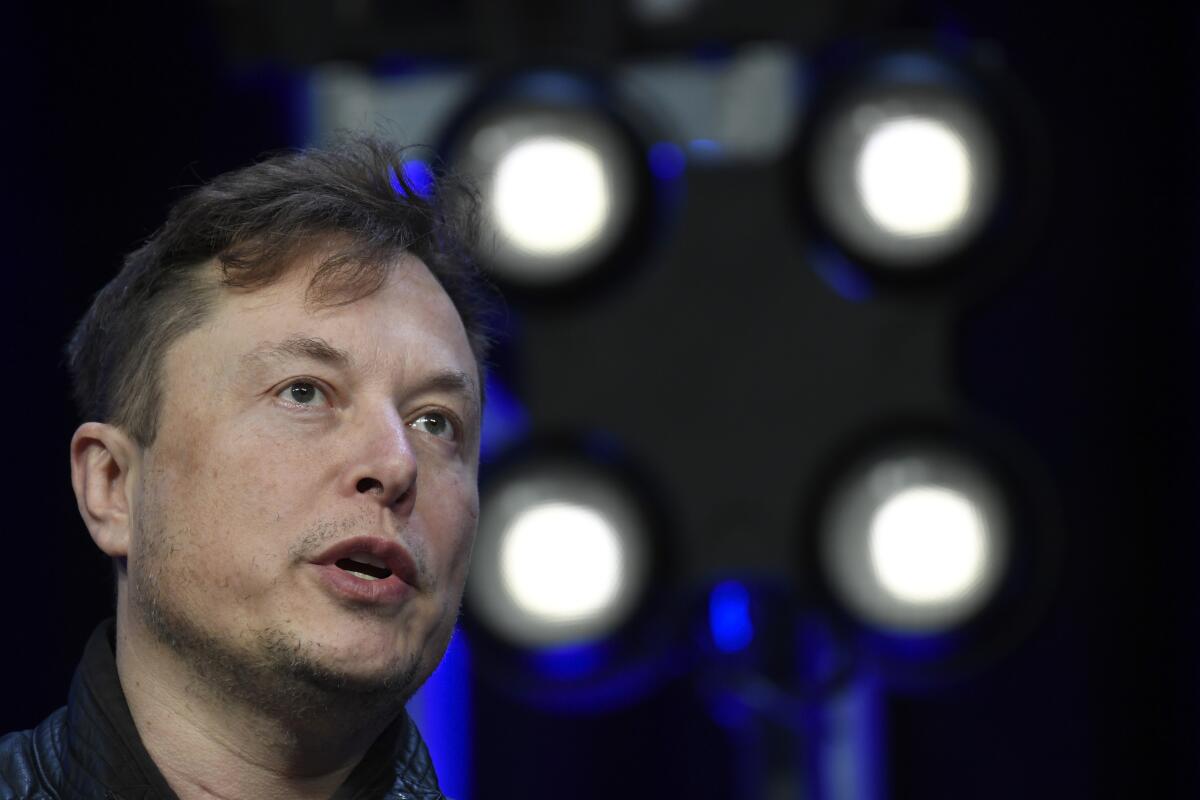

SEC probes Elon Musk and his brother Kimbal over stock sales

The Securities and Exchange Commission is investigating whether Tesla Inc. Chief Executive Elon Musk and his brother Kimbal violated securities laws when selling shares in the company late last year, according to a person familiar with the matter.

The regulator’s investigation is focused on transactions that took place just before Elon Musk polled his Twitter followers on whether he should sell a 10% stake in the company. The SEC is looking into whether any insider-trading rules were violated, said the person familiar with the matter, who asked not to be named because the inquiry is private.

The SEC declined to comment. Tesla and Elon and Kimbal Musk did not immediately respond to requests for comment. The investigation was reported earlier by the Wall Street Journal.

Tesla stock slumped after the CEO’s Nov. 6 Twitter poll, closing down the most in five months. Kimbal Musk, a Tesla board member, had sold 88,500 Tesla shares worth about $109 million on Nov. 5, according to a filing after the market closed that day.

After making a promise on Twitter, Tesla CEO Elon Musk has sold about 4.5 million shares of the electric car maker’s stock, raising over $5 billion.

This month, Tesla disclosed that it had received an SEC subpoena Nov. 16 seeking information about its governance processes and compliance with a settlement it reached with the agency in September 2018 over Elon Musk’s tweeting.

As part of that agreement, Tesla pledged to put in place controls to oversee the CEO’s communications, including his tweets, after the SEC alleged that the world’s richest person had committed securities fraud by saying on the social media platform that he had secured funding for the company to go private.

Musk and the SEC have been at loggerheads ever since. The agency sought to have a judge find the billionaire in contempt of the settlement the following year when he tweeted about Tesla’s production outlook without getting prior approval. The two sides agreed in April 2019 to amend their agreement by adding specific topics the Tesla chief couldn’t tweet about, or otherwise communicate in writing, without running it by a company lawyer.

The dispute gathered fresh steam last week, when Musk’s lawyer told a federal court that the SEC was targeting Musk and the electric car maker with an “unrelenting investigation” because the CEO is “an outspoken critic of the government.” The SEC has denied the allegation, and on Thursday a judge refused to hold a hearing on the claims.

Bloomberg writers Ed Ludlow, Bob Van Voris and Craig Trudell contributed to this report.