Judge skeptical of Hunter Biden’s effort to dismiss tax case as politically motivated

Lawyers for Hunter Biden asked a federal judge in Los Angeles to throw out nine tax-related charges, arguing that the president’s son is being vindictively prosecuted by the Justice Department and had his rights trampled by two IRS agents who publicly revealed his confidential tax records.

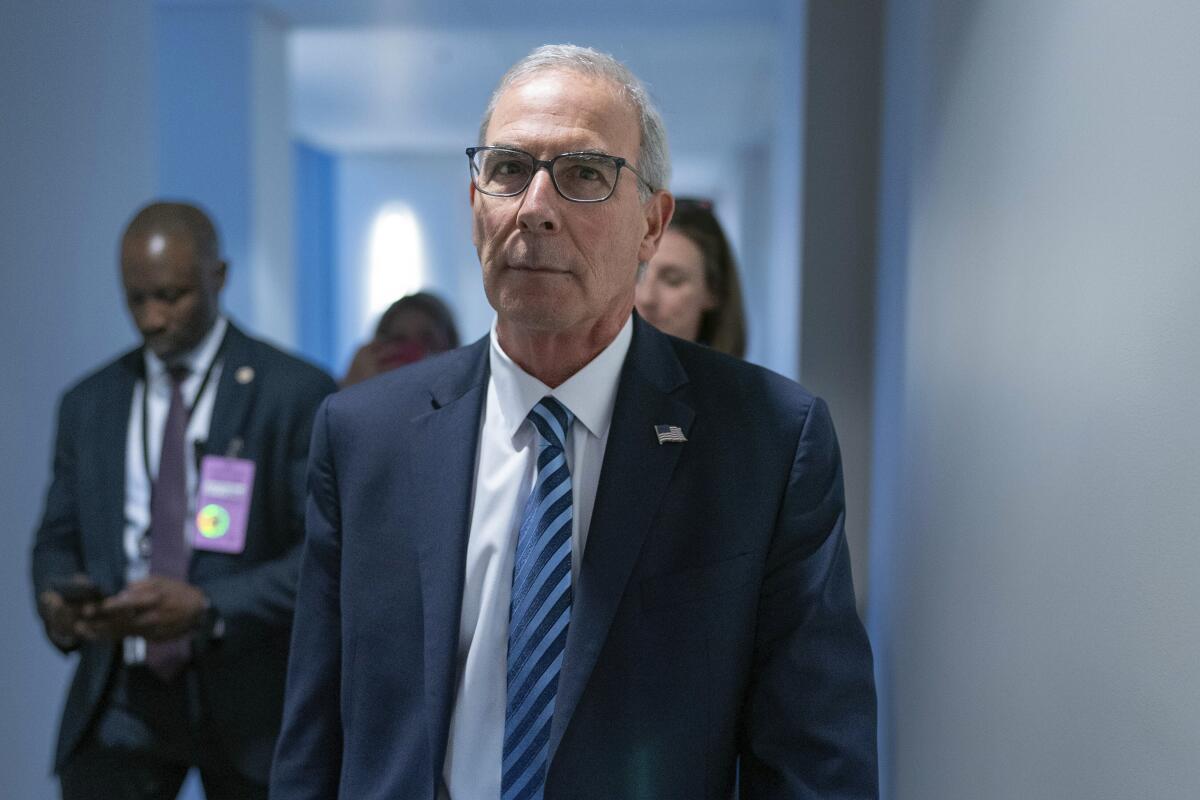

At a hearing Wednesday, U.S. District Judge Mark C. Scarsi appeared skeptical about Biden’s eight motions to dismiss the criminal charges, pointing out that his lawyers had little evidence to bolster some of their arguments.

Scarsi, an appointee of Donald Trump, said he would rule on the motions by April 17. Biden did not attend the hearing.

Led by Abbe Lowell, Biden’s legal team contended that intense political pressure from Republican lawmakers and former President Trump had improperly influenced the case, led to the collapse of a plea deal for Biden and prompted prosecutors to “up the ante” and secure far more serious indictments in both Delaware and Los Angeles.

“Is there any evidence that pressure from any outside entity influenced the prosecution team?” the judge asked Lowell on Wednesday.

“There really is no evidence. You cite to things on the internet,” the judge said at another point.

Lowell stressed that a timeline of events showed how prosecutors were improperly influenced, one example being the summoning of special counsel David Weiss to testify before Congress.

“It’s a timeline, but it’s a juicy timeline,” Lowell said.

Weiss’ prosecution team has accused Biden of failing to timely pay his taxes on $7 million of income from 2016 to 2019, a period when prosecutors say he “performed very little actual work.” Biden paid off his tax debt, with penalties and interest, in 2021.

How wealthy Hollywood attorney Kevin Morris joined forces with Hunter Biden to help the president’s son face his legal and personal problems.

Three of the nine charges in the indictment are felonies — tax evasion and twice filing false tax returns — and center on how Biden reported his 2018 taxes. Prosecutors allege he misclassified several personal expenses that year as business expenses, such as $30,000 for his daughter’s tuition, $1,500 to an exotic dancer and $11,500 to an escort, according to the indictment.

Weiss has separately indicted Biden in Delaware for allegedly lying on a federal firearms form.

Biden, 54, has pleaded not guilty in both cases. He filed similar motions to dismiss in the Delaware case, and the judge there also has not ruled.

The pair of indictments came after the collapse of a plea deal in July that would have allowed Biden to avoid a possible felony conviction and prison time, as well as the negative headlines of a trial during his father’s reelection campaign. Now he faces two trials this year, although the case in L.A. is more serious and complex than the Delaware one.

Much of Biden’s arguments to dismiss the tax charges center on the months before and after the plea deal fell apart.

Prosecutors allege Alexander Smirnov lied about an explosive allegation that has been central to Republican efforts to impeach President Biden and bolster Donald Trump’s campaign to return to power.

At that time, Weiss and his team faced a barrage of attacks from Trump over the plea deal, with Rep. Jim Jordan (R-Ohio), chair of the House Judiciary Committee, blasting it as a “sweetheart” deal. Gary Shapley and Joseph Ziegler, two Internal Revenue Service agents involved in Biden’s six-year criminal investigation, had by then come forward and given rounds of news interviews alleging that their inquiry was marred by political influence and special treatment toward their target because he was the president’s son.

Near the outset of Wednesday’s hearing, Lowell said, “There’s nothing regular about how this case was initiated, investigated.”

He put up a chart with several bullet points that he said showed “the selective and vindictive” nature of the prosecution.

Among the bullet points: not stopping the IRS agents’ “publicity tour”; the reopening of an investigation into FBI informant Alexander Smirnov’s now-debunked claims that Hunter Biden and his father received $5 million each from the Ukrainian energy company Burisma; and the appointment of Weiss as special counsel despite repeated statements that this was unnecessary.

Prosecutors counter that Biden’s argument is a fiction and a “conspiracy theory” that ignores a clear fact: Trump is no longer president and Biden’s father oversees the Justice Department.

Assistant U.S. Atty. Derek Hines, a member of Weiss’ team, told the judge that “there’s no link or causal connection whatsoever to the decision-making in this case” and that this timeline is “all they’re left with, with no direct evidence.”

Hines rejected the idea that he and other prosecutors were at Trump’s beck and call, awaiting the former president’s comments on Truth Social.

“It is absolutely outrageous [the] types of allegations that they’ve brought to the table,” Hines said.

Rep. James Comer, who is leading the House Republicans’ impeachment investigation of Joe Biden, has focused on the Biden family’s use of “shell companies.”

Separately, Biden’s lawyers want the case dropped on grounds of “outrageous government conduct,” arguing in a motion that Shapley and Ziegler, the two IRS agents who claimed to be whistleblowers, carried out “vigilante justice” and trampled on Biden’s constitutional right to due process.

But the judge splashed cold water on the argument.

“How are the agents responsible for what’s in the indictment?” Scarsi asked Lowell.

“Can I say [prosecutors] saw them on Fox News ... and that that’s why that was done? I can’t make the connection that that’s why that was done,” said Lowell, adding, “It was those two agents who started the dominoes.”

“There’s no dominoes,” countered Assistant U.S. Atty. Leo Wise, a lead prosecutor. “Where’s the proof that these two guys going on TV has anything to do with what we did?”

Biden’s lawyers had also cited the maelstrom of political pressure in their quest to enforce an immunity deal that was reached in tandem with the plea deal.

Prosecutors and Biden’s lawyers had drawn up what’s known as a diversion agreement last summer, which called for Biden to comply with certain terms, such as not using firearms or drugs. As part of the diversion agreement, prosecutors would offer him immunity on some charges, including tax crimes.

Prosecutors and Biden had signed the diversion agreement, which Biden’s lawyers say renders it binding and valid — even though the plea deal collapsed.

To bolster their argument, the defense points to comments by Wise in July, who said in court that the agreement “is a contract between the parties so it’s in effect until it’s either breached or a determination [of breach has been made], period.”

Federal prosecutors dispute that the diversion agreement is in force because a federal probation officer in Delaware had not formally approved it.

Scarsi signaled doubt about the immunity clause still being valid despite the fact that the plea deal fell apart, asking, “Why would Mr. Biden plead guilty if he already had immunity?”

Trump’s California-born advisor says he would deploy troops to blue states to seize undocumented immigrants, send them to camps, then expel them.

The remaining motions to dismiss allege technical errors in the case: that one count, based on taxes for 2016, is barred by the statute of limitations; that three counts each contain two offenses in the same charge; and that four of the charges should not have been filed in California, because they say that Biden did not officially reside in the Golden State until summer 2019.

The judge doubted whether he could rule on the venue question.

“It seems that this is going to be a question of fact for the jury to decide,” Scarsi said. “I’m hamstrung on making any ruling on venue.”

Biden’s final motion focuses on the 2019 tax year, arguing that charging him for failing to pay his taxes that year is “selective and vindictive” prosecution. Defense lawyers note that Biden filed his tax return on time that year, which coincided with the IRS’ pandemic-related deadline extensions, and paid his taxes two years later, with penalties and interest.

Biden’s lawyers say they have not found “a single case” in which a defendant filed his tax return on time in 2019 but was charged for not paying on time.

“When a taxpayer has paid all they owe under those circumstances, as Mr. Biden has, criminal tax charges simply are not brought,” the lawyers wrote.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.