Former crypto king Sam Bankman-Fried set for sentencing

Prosecutors are asking for FTX founder to spend up to 50 years in prison

Kelly O’Grady on SBF guilty verdict: FTX founder’s ‘hubris was on display’

FOX Business’ Kelly O’Grady reports on the trial of Sam Bankman-Fried after the former FTX CEO was found guilty on seven counts of criminal fraud.

FTX co-founder and ex-CEO Sam Bankman-Fried will learn his fate Thursday after being convicted last fall of defrauding investors and customers of the now-bankrupt cryptocurrency exchange.

The former crypto billionaire is slated to appear before U.S. District Judge Lewis Kaplan in Manhattan federal court, where he faces a sentence of up to 110 years behind bars.

PROSECUTORS WANT A 40 TO 50 YEAR PRISON SENTENCE FOR SAM BANKMAN-FRIED

Bankman-Fried was found guilty in November on two counts of wire fraud and five conspiracy counts.

Former FTX chief Sam Bankman-Fried leaves the Federal Courthouse following a bail hearing ahead of his October trial in New York City on July 26, 2023. (Photo by ANGELA WEISS/AFP via Getty Images / Getty Images)

Prosecutors are seeking a sentence of 40 to 50 years in prison, while the defense is arguing a 5¼- to 6½-year prison term would be appropriate.

Former Assistant U.S. Attorney Kevin J. O'Brien told FOX Business in an interview shortly after Bankman-Fried's conviction that he expects the 31-year-old to receive a sentence in "the teens" or possibly lower.

O'Brien, now a white-collar criminal defense lawyer, said he would not be surprised if the ex-CEO received a sentence comparable to 39-year-old Theranos founder Elizabeth Holmes, who is currently serving 11.25 years for her own fraud conviction.

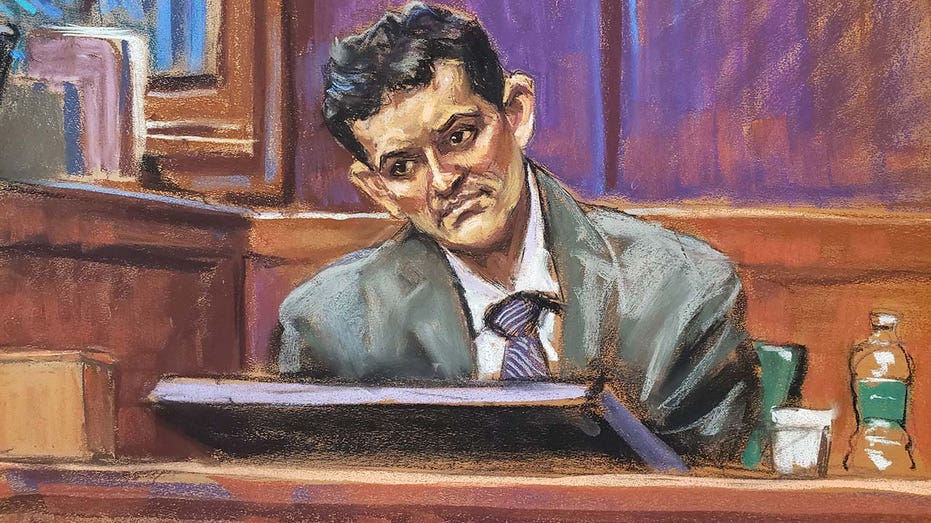

FTX founder Sam Bankman-Fried testifies on the witness stand in federal court in New York City on Monday, Oct. 30, 2023. (Jane Rosenberg)

The FTX founder, who capitalized on a rise in bitcoin and at one point accumulated an estimated $26 billion, is also expected to be ordered to pay restitution.

FTX AND SAM BANKMAN-FRIED'S TRIAL: THE PLAYERS

Bankman-Fried's crypto empire fell in November 2022, when FTX collapsed after reports that the exchange had merged assets with sister hedge fund Alameda Research, leading waves of customers to withdraw funds. Bankman-Fried was indicted the next month.

Bitcoin, which accounted for much of Bankman-Fried's net worth, fell as low as $15,000 and has since rebounded, following the approval of a bitcoin ETF by the Securities and Exchange Commission.

Prosecutors alleged that Bankman-Fried, who founded and controlled both FTX and Alameda, misappropriated and embezzled billions of dollars in FTX customer deposits, scheming to mislead investors and instructing other executives at his businesses to do the same. A New York jury agreed.

Representations of cryptocurrencies are seen in front of a displayed FTX logo in this illustration taken Nov. 10, 2022. (Reuters/Dado Ruvic/Illustration)

SAM BANKMAN-FRIED SAYS LAWYERS INVOLVED IN KEY DECISION BEFORE FTX COLLAPSE

Several members of Bankman-Fried's inner circle testified against him during the trial. The prosecution's key witnesses were Caroline Ellison — Bankman-Fried's ex-girlfriend and the former CEO of Alameda Research — as well as FTX co-founder Gary Wang and former FTX engineering chief Nishad Singh. The trio had all previously pleaded guilty and agreed to cooperate with the government.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Bankman-Fried also took the stand in his own defense, where he admitted to making mistakes but insisted he did not defraud or steal from anyone.