PHOTO

Emirates NBD’s profit surged 67% to a record AED 6.7 billion in the first quarter of 2024 compared to the previous quarter and up a strong 12% y-o-y, propelled by regional growth, increased transaction volumes, a low-cost funding base and substantial impaired loan recoveries. The Group’s asset base surpassed AED 900 billion as Retail lending had its strongest ever quarter and Corporate lending closed landmark deals across the region. The branch presence in the Kingdom of Saudi Arabia more than doubled to 18 branches over the last year and we refreshed our Egyptian franchise, as our enhanced international footprint and digital capabilities drove further growth.

Emirates NBD’s market-leading deposit franchise grew AED 26 billion in the first quarter, with customer campaigns, digital banking and promotions delivering a remarkable AED 21 billion increase in low-cost Current and Savings Accounts. Credit quality improved significantly, and the Group registered an impairment credit on regularisation of payments as clients benefited from a buoyant economy. All business units delivered an outstanding performance. Retained earnings boosted capital ratios and the rock-solid balance sheet makes Emirates NBD a regional powerhouse, providing the platform for future growth.

Key Highlights – First Quarter 2024

- 67% surge in profit q-o-q on significant balance sheet growth, a stable low-cost funding base, increased transaction volumes and substantial recoveries

- Total income up 3% q-o-q to AED 10.7 billion on excellent deposit mix, solid loan growth and strong fee & commission growth across all business segments

- 5% asset growth as balance sheet surpasses AED 900 billion milestone

- Solid loan growth, up 2.3% in the first quarter on record AED 9 billion Retail financing with Corporate gross lending up AED 24 billion as landmark deals across the region were successfully closed

- Deposit mix is a key strength growing AED 26 billion in the first quarter, including a remarkable

AED 21 billion of low-cost Current and Savings Accounts - Net interest margin remains very strong at 3.52%

- Impairment credit of AED 0.9 billion on regularisation of loan payments as clients benefit from a buoyant economy with impaired loan ratio improving to 4.4%

- Earnings per share up significantly to 104 fils from 93 fils in the first quarter of 2023

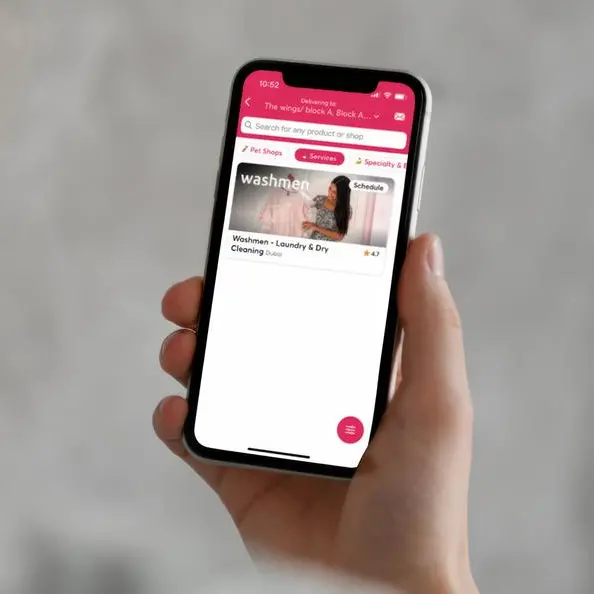

- Emirates NBD’s investment in customer focused services & products is propelling business growth

- AUMs grew by an impressive 37% y-o-y, reflecting early success of our ongoing wealth management strategy

- AED 500 million of competitive financing allocated to SMEs to support 'Dubai International Growth Initiative', facilitating Dubai based SMEs’ global expansion

- Extended inward cut-off time for USD payments from 6:30pm to 10pm – collected more than

USD 33 billion through 100,000+ transactions in extended hours - Aviation Desk established to facilitate Aviation Financing across the region

- First Synthetic USD Structured Investment successfully concluded, providing client with yield-enhancing investment opportunity

- Enhancing transport infrastructure through innovative AED 735 million Green Term Loan Facility

- Advanced analytics data-mining project well established with 24 live use cases, improving customer service and monetising Emirates NBD’s 20-million daily customer data points

- smartGUARANTEES solution provided to Corporate customers utilising Robotics to automatically read inward text and process guarantee, completely eliminating paper usage and making process easier, faster & more accurate

- Looking to the future, Emirates NBD is transforming into a data-first, digital-focused and environmentally responsible regional powerhouse

- 20-year presence in Kingdom of Saudi Arabia with branch network doubling to 18 in last year driving 19% loan growth in Q1-24

- Emirates Islamic celebrates 20-years of providing innovative Sharia’h compliant banking, serving over 650,000 customers as it delivered a record profit of AED 811 million in Q1-24

- Emirates NBD Capital (‘EmCap’) Top-3 league table position in International Sukuk and Top-5 in CEEMEA USD Public Bonds & Sukuk in Q1-24, raising capital for regional customers

- Generative AI implementation across business operations in partnership with Microsoft

- Leading GCC bank in ESG ranked by Sustainalytics and rated 5 out of 311 diversified banks globally

- ESG Report 2023 published in Q1-24 reinforcing our commitment to transparency in ESG reporting

- Global SustainTech Accelerator Programme launched, empowering Green FinTech companies to develop innovative solutions and support a climate-resilient future

- Carbon future contract trading facility launched, giving clients access to this rapidly growing asset class and align with the UAE’s Net Zero action plan