- News

- Business News

- India Business News

- Swiggy IPO: Food delivery platform bags shareholder approval for $1.2 billion offering; know all the details here

Trending

Swiggy IPO: Food delivery platform bags shareholder approval for $1.2 billion offering; know all the details here

Swiggy, a Bengaluru-based company, approved for IPO to raise funds. Major investors include Prosus and SoftBank. Co-founders own stakes. Revenue rises by 45%, net loss up by 15%. Majety appointed CEO, Reddy Head of Innovation.

Swiggy IPO: Swiggy, a food and grocery delivery company based in Bengaluru, has received approval from its shareholders for an initial public offering (IPO). According to regulatory filings, the company plans to raise up to Rs 3,750 crore ($450 million) through new shares, and another Rs 6,664 crore ($800 million) through an offer for sale.

According to ET, Swiggy hasn't yet submitted its IPO documents to the Securities and Exchange Board of India (SEBI), but it plans to raise about Rs 750 crore in a pre-IPO round from anchor investors.Swiggy's IPO is part of a wave of new-age startups planning to go public this year, including omnichannel retailer Firstcry, electric vehicle maker Ola Electric, and office space provider Awfis, among others.

The filing stated that the shareholders of the company have given their consent and approval to create, issue, offer, allot, and/or transfer equity shares totaling up to Rs 37,501 million through a fresh issue, as well as allow the offer for sale of equity shares by existing shareholders up to Rs 66,640 million.

ALSO READ | Good signal for Indian IT sector job seekers: Contractual hiring shows demand uptick

Swiggy shareholding pattern

Prosus, a Dutch-listed company, is Swiggy's biggest investor, owning 33% of the company. SoftBank holds the second-largest stake. Other notable shareholders are Accel, Elevation Capital, Meituan, Norwest Venture Partners, Tencent, DST Global, Qatar Investment Authority, Coatue, Alpha Wave Global, Invesco, Hillhouse Capital Group, and GIC.

The co-founders of Swiggy—Sriharsha Majety, Nandan Reddy, and Rahul Jaimini—own 4%, 1.6%, and 1.2% stakes, respectively, according to data from Tracxn. Jaimini left his operational role at Swiggy in 2020 to work on a different venture called Pesto Tech.

Swiggy names Majety CEO, Reddy Head of Innovation

During the extraordinary general meeting (EGM) on April 23, Swiggy appointed Majety and Reddy as executive directors. Majety was named managing director and group CEO, while Reddy took on the role of whole-time director and head of innovation.

ALSO READ | Kotak Mahindra Bank shares plunge 10% after RBI bars onboarding customers digitally

At the time of publishing, a Swiggy spokesperson had not responded to requests for comment.

Swiggy's revenue soars 45%, net loss up

Swiggy's operational revenue for the fiscal year ending in March 2023 was Rs 8,265 crore, reflecting a 45% increase compared to FY22. However, the company's net loss also rose by 15%, totaling Rs 4,179 crore.

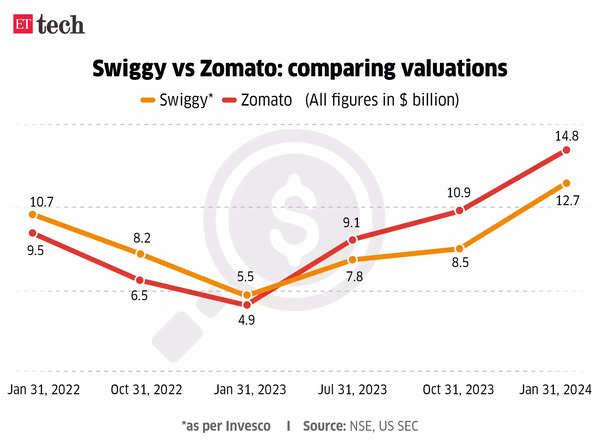

On April 9, it was reported that Invesco, which led Swiggy's $700 million funding round in January 2022, had raised Swiggy's valuation to $12.7 billion. Similarly, Baron Capital, another Swiggy investor, also updated Swiggy's fair value to $12.1 billion last month in its records.

According to ET, Swiggy hasn't yet submitted its IPO documents to the Securities and Exchange Board of India (SEBI), but it plans to raise about Rs 750 crore in a pre-IPO round from anchor investors.Swiggy's IPO is part of a wave of new-age startups planning to go public this year, including omnichannel retailer Firstcry, electric vehicle maker Ola Electric, and office space provider Awfis, among others.

The filing stated that the shareholders of the company have given their consent and approval to create, issue, offer, allot, and/or transfer equity shares totaling up to Rs 37,501 million through a fresh issue, as well as allow the offer for sale of equity shares by existing shareholders up to Rs 66,640 million.

ALSO READ | Good signal for Indian IT sector job seekers: Contractual hiring shows demand uptick

Swiggy's shareholders approved a special resolution during an extraordinary general meeting (EGM) on April 23.

Swiggy shareholding pattern

Prosus, a Dutch-listed company, is Swiggy's biggest investor, owning 33% of the company. SoftBank holds the second-largest stake. Other notable shareholders are Accel, Elevation Capital, Meituan, Norwest Venture Partners, Tencent, DST Global, Qatar Investment Authority, Coatue, Alpha Wave Global, Invesco, Hillhouse Capital Group, and GIC.

The co-founders of Swiggy—Sriharsha Majety, Nandan Reddy, and Rahul Jaimini—own 4%, 1.6%, and 1.2% stakes, respectively, according to data from Tracxn. Jaimini left his operational role at Swiggy in 2020 to work on a different venture called Pesto Tech.

Swiggy names Majety CEO, Reddy Head of Innovation

During the extraordinary general meeting (EGM) on April 23, Swiggy appointed Majety and Reddy as executive directors. Majety was named managing director and group CEO, while Reddy took on the role of whole-time director and head of innovation.

ALSO READ | Kotak Mahindra Bank shares plunge 10% after RBI bars onboarding customers digitally

At the time of publishing, a Swiggy spokesperson had not responded to requests for comment.

Swiggy's revenue soars 45%, net loss up

Swiggy's operational revenue for the fiscal year ending in March 2023 was Rs 8,265 crore, reflecting a 45% increase compared to FY22. However, the company's net loss also rose by 15%, totaling Rs 4,179 crore.

On April 9, it was reported that Invesco, which led Swiggy's $700 million funding round in January 2022, had raised Swiggy's valuation to $12.7 billion. Similarly, Baron Capital, another Swiggy investor, also updated Swiggy's fair value to $12.1 billion last month in its records.

End of Article

FOLLOW US ON SOCIAL MEDIA