$6.1 billion in student loan debt canceled for enrollees at for-profit Art Institutes

When the for-profit Art Institutes operated by Education Management Corp. shut down in the wake of fraud and illegal recruiting allegations, they left thousands of former students saddled with debts amassed in overpriced courses of study — until this week.

On Wednesday, the Biden administration announced that it was canceling $6.1 billion in student loan debt for people enrolled at any Art Institute from January 2004 through October 2017 — 317,000 former students in all, nearly 42,000 of whom are in California. Education Management, known as EDMC, operated multiple Art Institute branches in California, including in Hollywood, Santa Monica and San Bernardino.

“This institution falsified data, knowingly misled students, and cheated borrowers into taking on mountains of debt without leading to promising career prospects at the end of their studies,” the White House wrote in a statement. “We will never stop fighting to deliver relief to borrowers, hold bad actors accountable, and bring the promise of college to more Americans.”

Abel Hernandez, 44, of San Francisco exemplifies the damage caused by EDMC’s tactics.

Hernandez said he enrolled at the Art Institute of San Francisco in the summer of 2005, studying media arts and animation, hoping that one day he would work for a studio giant like Pixar or Nickelodeon. But tuition became expensive; within three years he saw it jump from $300 a month to $750.

“They told me they had a job placement of 82% and promised high-paying jobs, but it turns out a lot of the job placements they had, for example, if your degree was in fashion or video game design, they would consider [retailers] H&M or GameStop as part of your industry,” Hernandez said in a phone interview. “They lied about the cost of tuition and forced you to take on more loans.”

After months of negotiations, the administration is proposing a rule to reduce the debts of millions of borrowers. But the plan will likely face legal challenges.

“They would keep telling me to keep taking on more loans,” he added. “ They would say: ‘You’re not prioritizing your education.’”

Hernandez said it got to the point that he couldn’t afford it and dropped out of school in the spring of 2008. He would later learn about the for-profit college company’s questionable tactics following a series of investigations and settlement agreements, including one in 2015 for $95 million over fraud allegations by the U.S. Department of Justice.

In that lawsuit, U.S. officials accused the parent company of operating its network of schools like a “recruitment mill” by paying admissions personnel based on the number of students they enrolled, a violation of federal law. U.S. officials said that meant the company had falsely obtained $11 billion in state and federal aid between 2003 through 2011.

The U.S. Department of Education, which independently reviewed evidence that the attorneys general of Iowa, Massachusetts and Pennsylvania obtained in their own lawsuits against EDMC, said the company misled students by claiming that more than 80% of graduates obtained employment related to their fields of study. It also said the company displayed inaccurate average salaries.

Now defunct, EDMC sold or shuttered many of its campuses following the 2015 settlement. The final eight campuses were shut down last year.

EDMC’s demise did nothing to help former students like Hernandez, however. Struggling under the weight of more than $70,000 in loans he obtained from the Art Institute of San Francisco, he saw his credit score dip so low that he couldn’t borrow money or pass a credit check, forcing him to live with his parents.

The debt left Hernandez feeling like he was just surviving day to day.

So when he received an email Wednesday that the Biden administration had canceled student loan debt for people who attended the Art Institutes, he felt an overwhelming sense of relief and gratitude.

“All I could do was scream and cry because I was so shocked and so relieved. I felt free,” he said. “I’ve had this hanging over my head for so long that I had forgotten what it was like not to have that debt.”

The total amount of student debt relief approved by the Biden administration now comes to almost $160 billion for nearly 4.6 million borrowers, according to the Education Department. That amount, the White House said, includes $29 billion in debt relief for 1.6 million borrowers whose colleges cheated them or closed abruptly. Federal law gives the Education Department authority to cancel federal student loan debt for students who are defrauded by their college or trade school.

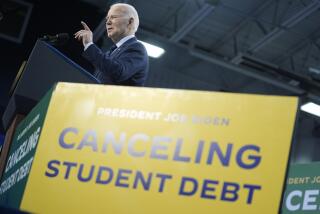

The student debt announcement was Biden’s final event during a two-day swing in the Los Angeles area. He headlined a major fundraiser the previous night.

Some critics of Biden’s moves on student debt say they’re not fair to taxpayers or to the students and families that made financial sacrifices to pay off their loans. Supporters of loan forgiveness counter that insufficient disclosures by colleges, poorly designed loan programs and inept servicing led many borrowers into debt traps.

And then there are operations like EDMC, which federal officials say pushed enrollees deeply into debt under false pretenses.

“For more than a decade, hundreds of thousands of hopeful students borrowed billions to attend the Art Institutes and got little in return,” U.S. Secretary of Education Miguel Cardona said in a written statement. “We must continue to protect borrowers from predatory institutions — and work toward a higher education system that is affordable to students and taxpayers.”

“I do appreciate what [Biden] has done for us,” Hernandez said. “I took out these loans during the Bush II years; Obama didn’t help me, Trump didn’t help me, but Biden came through for me.”

Hernandez said that since receiving the notice on Wednesday he’s heard from other classmates who said they too got the same email.

“It’s a good time for us all who have been scammed by this school.”

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.