- News

- Business News

- India Business News

- Sensex swings 1,600 pts, ends below 74,000 on selloff

Trending

Sensex swings 1,600 pts, ends below 74,000 on selloff

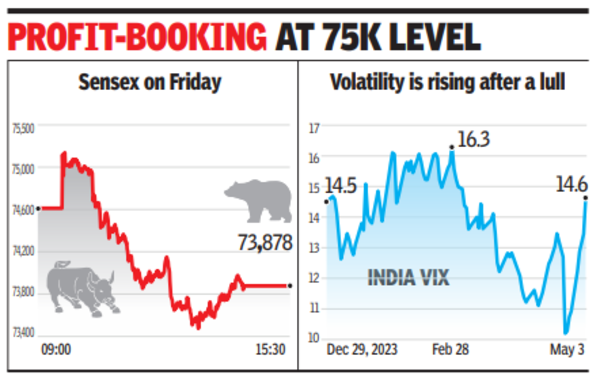

Selling across the board occurred after the Sensex reached the 75,000 mark once again in early trades on Friday, causing the index to drop by 733 points or 1% to close at 73,878. Reliance Industries, L&T, and HDFC Bank were the main contributors to the day's loss, as foreign funds sold aggressively. Market participants mentioned that taking profits at higher levels led them to sell off their holdings.

MUMBAI: Across the board selling after sensex scaled the 75K mark once again in early trades on Friday pulled the index down by 733 points or 1% to close at 73,878. Reliance Industries, L&T and HDFC Bank contributed the most to the day’s loss during which foreign funds sold aggressively.

Market players said profit booking at higher levels, also investors’ unease about US labour market data that was due after the domestic markets closed for trading for the weekend, prompted them to liquidate their positions.

“Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market,” said Vinod Nair, Head of Research, Geojit Financial Services. “However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII exposure to the domestic market.”

On Friday, foreign funds were net sellers at Rs 2,392 crore while domestic funds were net buyers at Rs 691 crore, BSE data showed.

Of the 30 sensex stocks, only five closed with gains including the two from the Bajaj group__Bajaj Finance and Bajaj Finserv. Despite selling pressure across sectors, these two closed higher after the RBI on Thursday lifted curbs on Bajaj Finance’s digital lending business that was imposed about six months ago. In the broader market too, laggards outnumbered winners with 2,411 declines on BSE to 1,421 advances.

The day’s selling also left investors poorer by about Rs 2.2 lakh crore with BSE’s market cap now at Rs 413.1 lakh crore.

Market players said profit booking at higher levels, also investors’ unease about US labour market data that was due after the domestic markets closed for trading for the weekend, prompted them to liquidate their positions.

“Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market,” said Vinod Nair, Head of Research, Geojit Financial Services. “However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII exposure to the domestic market.”

After the markets closed in India, the US said it had added about 1.75 lakh people to its labour force, much lower than what was estimated. This led to a sharp rally on Wall Street with most leading indices up over 1% each. This could have a positive impact on Dalal Street when trading begins in the new week, dealers said.

On Friday, foreign funds were net sellers at Rs 2,392 crore while domestic funds were net buyers at Rs 691 crore, BSE data showed.

Of the 30 sensex stocks, only five closed with gains including the two from the Bajaj group__Bajaj Finance and Bajaj Finserv. Despite selling pressure across sectors, these two closed higher after the RBI on Thursday lifted curbs on Bajaj Finance’s digital lending business that was imposed about six months ago. In the broader market too, laggards outnumbered winners with 2,411 declines on BSE to 1,421 advances.

The day’s selling also left investors poorer by about Rs 2.2 lakh crore with BSE’s market cap now at Rs 413.1 lakh crore.

End of Article

FOLLOW US ON SOCIAL MEDIA