- News

- Business News

- India Business News

- Tougher project fin rules hit PSU infra NBFC stocks

Trending

Tougher project fin rules hit PSU infra NBFC stocks

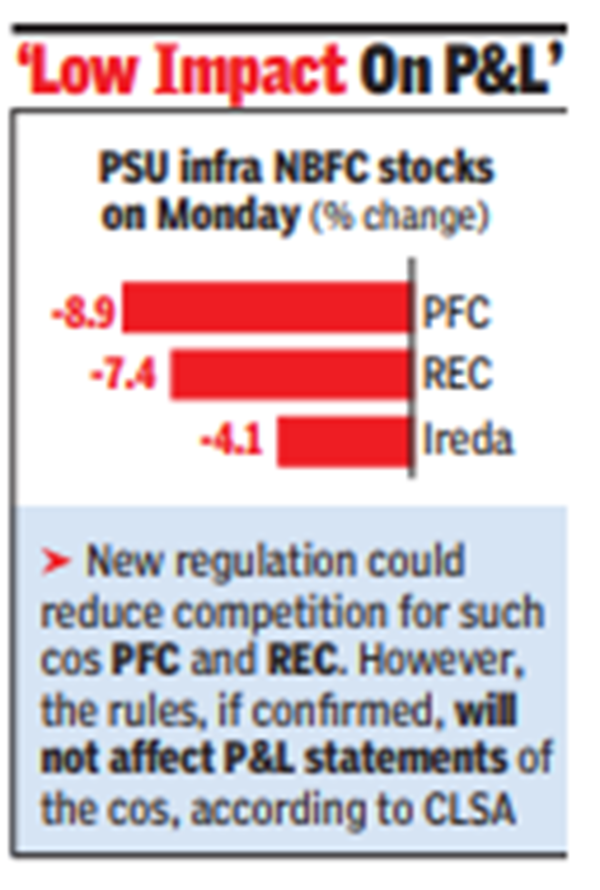

Mumbai: RBI's proposal to tighten lending criteria for project financing by banks and NBFCs weighed on investor sentiment as they sold PSU stocks like PFC, REC and Ireda on Monday, pulling down prices by as much as 12% intraday.

Brokerages CLSA and IIFL, however, assured investors that the impact of the proposals, even if made into rules, may not be much on the profitability of project financiers.It could however prompt them to replenish their capital to meet regulatory requirements.

On Monday, after dipping sharply in opening trades, PFC closed 8.9% down at Rs 438, REC closed 7.4% down at Rs 517 and Ireda closed 4.1% down at Rs 172.

Bankers say that RBI's proposal to impose a 5% provision requirement on project loans might have been triggered by the expected credit loss (ECL) norms, which require banks to make provisions based on past experience of default. ECL norms are prudential guidelines in keeping with global best practices.

"Whenever ECL norms are notified, banks will have to set aside provisions for defaults based on their experience, which means it could be over 5%," said a banker.

Brokerages CLSA and IIFL, however, assured investors that the impact of the proposals, even if made into rules, may not be much on the profitability of project financiers.It could however prompt them to replenish their capital to meet regulatory requirements.

On Monday, after dipping sharply in opening trades, PFC closed 8.9% down at Rs 438, REC closed 7.4% down at Rs 517 and Ireda closed 4.1% down at Rs 172.

According to a report by IIFL, infra-focused NBFCs like REC, PFC and Ireda can see a potential hit of 200-300 basis points (100 basis points = 1 percentage point) to their capital ratio. "Valuation of these NBFCs can also be potentially impacted," the report said.

Bankers say that RBI's proposal to impose a 5% provision requirement on project loans might have been triggered by the expected credit loss (ECL) norms, which require banks to make provisions based on past experience of default. ECL norms are prudential guidelines in keeping with global best practices.

"Whenever ECL norms are notified, banks will have to set aside provisions for defaults based on their experience, which means it could be over 5%," said a banker.

End of Article

FOLLOW US ON SOCIAL MEDIA