The eurozone economy came close to stalling in September after declines in global trade and the threat of a no-deal Brexit triggered the fastest fall in manufacturing output in nearly seven years.

Germany was the main driver of the slump after a survey of private sector activity found that the growing threat to international trade from the tit-for-tat US-China trade war had left it in the worst position since 2009.

Often referred to as the powerhouse of the 19-member currency bloc’s economy, Germany has suffered a year-long slowdown that has accelerated in recent months.

The German purchasing managers’ index (PMI) for manufacturing fell to 41.4 in September, from 43.5 in the previous month, and well below the 50 mark that separates expansion from contraction.

It contributed to a deepening manufacturing recession across the eurozone, where output fell at the sharpest pace since 2012 and optimism among business executives fell to its lowest level for seven years.

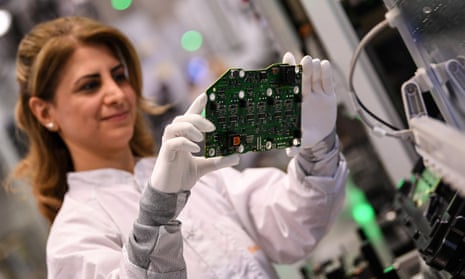

Car manufacturers were among the worst hit by a rise in Chinese and US import tariffs and preparations for the UK leaving the EU without a deal next month.

In a joint statement over the weekend, chiefs from 23 automotive business associations across Europe cautioned against the UK leaving without an agreement, saying it would lead to huge extra costs and possible job losses across the industry, including in the UK.

Germany’s overall composite PMI, which includes the services sector and manufacturing industry, was supported by a services sector that continued to expand, though not enough to prevent the PMI slipping to 49.1 from 51.7 in August.

The composite PMI for the eurozone fell to 50.4 in September, down from 51.9 in August to signal the weakest expansion of output across manufacturing and services since June 2013.

The euro dropped sharply against the dollar on the news, to $1.097, though it climbed against sterling, with one pound worth €1.13.

Analysts said the figures, produced by the data firm IHS Markit, revealed that the slowdown in the eurozone’s largest economy justified the European Central Bank’s move earlier this month to cut interest rates and provide a package of stimulus measures to boost growth.

Fiona Cincotta, a market analyst at spread betting firm City Index, said: “The fact the euro has dropped below the key $1.10 level suggests that traders believe there could be more monetary policy stimulus to come from the ECB.”

IHS Markit said the slowdown was driven by new orders for goods and services falling for the first time since January, dropping at the sharpest rate since June 2013. Firms were reluctant to hire new staff, the survey found, leading to the slowest increase in job creation since January 2015.

Simon Wells, the chief European economist at HSBC, said: “Today’s PMIs make grim reading, particularly for Germany. Since the peak of the German manufacturing PMI in December 2017 there have been a few occasions where signs of stabilisation have been snuffed out.

“The latest falls have added a new leg down after a period of relative stability since the end of the first quarter. With the PMIs now signalling a deeper German manufacturing contraction and increasingly showing the manufacturing sector infecting the service sector, the risk of outright German recession is high.”

IHS Markit’s chief business economist, Chris Williamson, said Germany was likely to avoid a repeat of the 0.1% decline in gross domestic product during the second quarter if firms continued to work through backlogs of orders to keep staff busy while new orders dried up.

He said third-quarter GDP was on course to rise by 0.1%, though with momentum weakening as the quarter closed.

“The goods-producing sector is going from bad to worse, suffering its steepest downturn since 2012, but a further worrying trend is the broadening out of the malaise to the service sector, where the rate of growth has now slowed to one of the weakest since 2014,” he said.