Key 2008 Financial Crisis Players Are Back for CoronavirusIn Throwback to 2008, Familiar Faces Emerge in the Virus Crisis

From Larry Fink to Jamie Dimon, these major figures are in place again as a pandemic wreaks havoc on global markets.

The origins of the 2008 financial crisis were nothing like what’s driving the current meltdown. Then, a housing bubble puffed up by overextended banks and homeowners was the culprit. Now, a global pandemic has brought markets and economies to their knees.

Yet policy makers are dusting off many of the same solutions to address the economic and financial fallout from the spread of Covid-19. The Federal Reserve, for example, has resurrected many of the emergency-lending programs it first introduced in 2008 to inject cash into the system.

Another similarity: the cast of characters. Some of the same people who helped solve the 2008 financial crisis are back on the front lines. Here again is BlackRock founder Larry Fink, advising the Fed with skills honed the last time around.

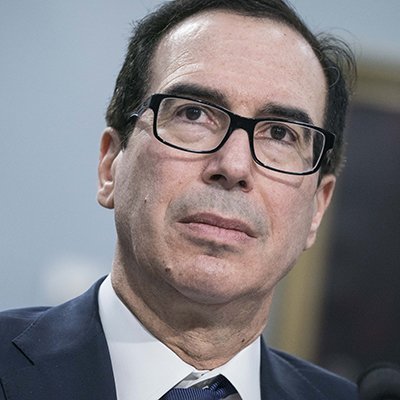

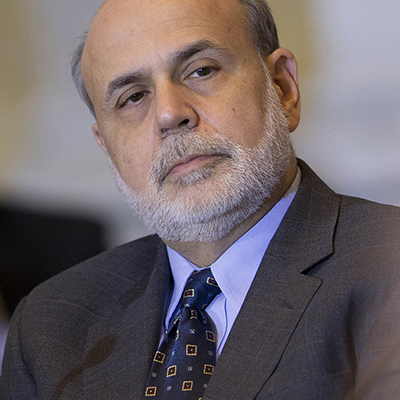

Some have switched sides. Treasury Secretary Steven Mnuchin, who purchased one of the biggest failed subprime lenders in the crisis 12 years ago, is leading the Trump administration’s economic response to the one raging now. Meanwhile, former Fed Chairman Ben Bernanke is advising companies likely benefiting from the government’s stimulus efforts.

Co-founder, Dune Capital Management

U.S. Treasury Secretary

In early 2009, Mnuchin led a group of investors who purchased failed subprime mortgage lender IndyMac and ran the bank until its sale in 2015. Mnuchin is now leading President Donald Trump's economic response to the pandemic.

Chairman, Federal Reserve

Fellow, Brookings Institution; Senior Adviser, Citadel & PIMCO

Bernanke's Fed created almost a dozen lending facilities to pump cash into the financial system when it nearly froze during the last crisis. Current Chairman Jerome Powell has dusted off many of those programs to support liquidity and put a floor under falling securities prices, which have helped financial firms cope with fallout from the pandemic.

President, Federal Reserve Bank of New York

President, Warburg Pincus

Geithner was the third leg of the powerful trio managing the government's response during the last crisis, and became Treasury Secretary in 2009 under President Barack Obama. Now he helps manage the investment process at a private equity firm.

CEO, BlackRock Inc.

CEO, BlackRock Inc.

During the last crisis, as banks crumbled and lost credibility, Fink emerged as a trusted adviser to the government and the Fed, helping to value esoteric securities they'd purchased or guaranteed. He's doing the same this time around, aiding the Fed with a bond-buying program aimed at putting a floor under market prices.

CEO, JPMorgan Chase & Co.

CEO, JPMorgan Chase & Co.

Dimon's JPMorgan took over Bear Stearns and Washington Mutual during the last crisis, when it was one the few lenders strong enough to make major acquisitions as rivals failed. JPMorgan is now the largest U.S. bank, and while Dimon still has the ears of policy makers, he had emergency heart surgery in early March and only got back to work in recent days.

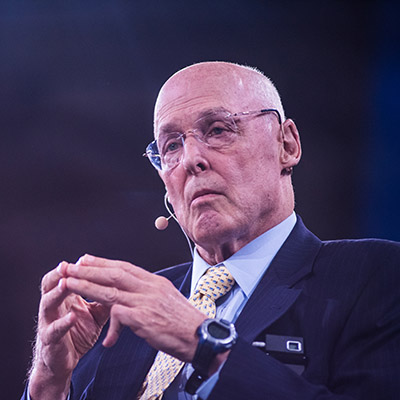

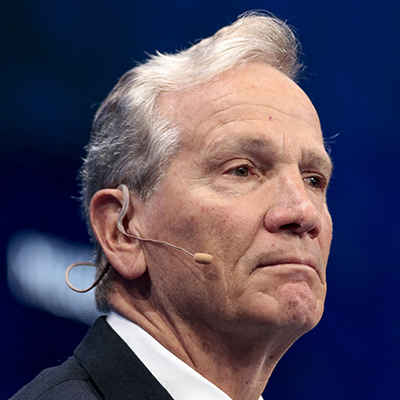

U.S. Treasury Secretary

Chairman, Paulson Institute

Paulson was President George W. Bush's point man during the financial crisis of 2008, directing the government's response in coordination with the Fed. He's now focused on improving China-U.S. relations. Last week he warned the leaders of the Treasury and Fed that it will be difficult and messy to get the financial support Congress provided to where it's needed most.

Head of Sales & Trading, Merrill Lynch & Co.

Chief Operating Officer, Bank of America Corp.

Montag joined Merrill Lynch just before it was sold to Bank of America on the same weekend Lehman Brothers failed. The purchase led to Bank of America needing a government bailout. He ran the investment-banking arm at BofA for years, and remains an influential voice at the second-largest U.S. lender.

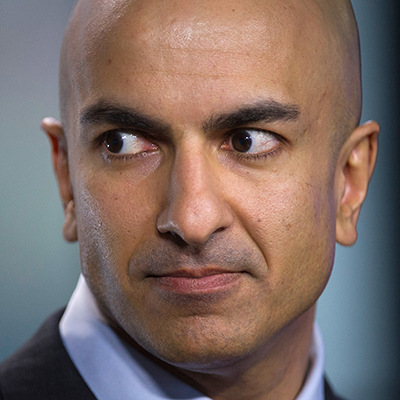

Assistant Secretary, U.S. Treasury

President, Federal Reserve Bank of Minneapolis

Kashkari designed and ran the Treasury's $700 billion TARP program to bail out banks and carmakers during the previous crisis. He then became one of the harshest critics of big banks, asking that their capital levels be increased to improve safety. One lesson from the financial crisis was that people who lost their jobs took a decade to recover, he said in an interview last week with the Wall Street Journal. That means fast intervention is needed to make sure as many workers as possible keep their jobs this time, he said.

Chairman, Sullivan & Cromwell LLP

Chairman, Sullivan & Cromwell LLP

Cohen got involved in the government's response to the 2008 crisis because of his client, Fannie Mae, and ended up becoming a key broker in most efforts trying to merge, sell or rescue financial firms. He's still considered the dean of Wall Street lawyers.

CEO, Bear Stearns Cos.

Co-Chairman, Guggenheim Securities LLC

Schwartz was named CEO of Bear Stearns just a few months before it became the first investment bank to collapse when the subprime-mortgage bubble burst. His new firm, Guggenheim, will likely be working on many of the corporate restructurings spurred by the current crisis.

Co-head of corporate restructuring, Lazard Inc.

Co-Chairman, Guggenheim Securities LLC

Millstein joined the Treasury in 2009, and oversaw the restructuring of American International Group Inc., the insurance firm that made big bets on the subprime market. He'll likely be working on a raft of new restructurings in the current crisis as firms struggle with the economic fallout.

Vice Chairman, Lazard Ltd.

Senior Managing Director, Apollo Global Management

Parr advised Bear Stearns in its sale to JPMorgan. His current employer, Apollo, has the biggest credit business among its peers, taking on lending that banks don't want.

With assistance from Max Abelson. Edited by Steve Dickson.